Mass Tax Connect Login has become a crucial tool for taxpayers in Massachusetts to manage their tax-related activities efficiently. Whether you're an individual taxpayer or a business entity, understanding this system can significantly streamline your tax obligations. This article will provide you with an in-depth guide on how to navigate and utilize Mass Tax Connect effectively.

Managing taxes can often feel overwhelming, especially when dealing with multiple deadlines and forms. However, the Massachusetts Department of Revenue (DOR) has introduced Mass Tax Connect to simplify the process. This platform not only allows users to file taxes but also offers various services that enhance the overall tax experience.

By the end of this article, you'll have a clear understanding of how Mass Tax Connect Login works, its features, and how it can benefit you as a taxpayer. Let's dive into the details and uncover everything you need to know about this powerful tool.

Read also:Unveiling David Feldmans Net Worth A Comprehensive Guide

Table of Contents

- Introduction to Mass Tax Connect Login

- Key Features of Mass Tax Connect

- Benefits of Using Mass Tax Connect

- Setting Up Your Mass Tax Connect Account

- Step-by-Step Guide to Mass Tax Connect Login

- Common Issues and Troubleshooting Tips

- Ensuring Account Security

- Filing Taxes Through Mass Tax Connect

- Additional Resources and Support

- Conclusion and Call to Action

Introduction to Mass Tax Connect Login

What is Mass Tax Connect?

Mass Tax Connect is an online platform developed by the Massachusetts Department of Revenue (DOR) to assist taxpayers in managing their tax obligations. It serves as a centralized hub for all tax-related activities, including filing taxes, viewing payment history, and managing account information.

Why Use Mass Tax Connect?

Using Mass Tax Connect Login offers several advantages, including convenience, security, and efficiency. The platform is designed to cater to both individual taxpayers and businesses, ensuring a seamless experience for all users.

Key Features of Mass Tax Connect

Comprehensive Tax Management

One of the standout features of Mass Tax Connect is its ability to handle a wide range of tax-related tasks. Here are some of the key functionalities:

- File taxes electronically

- View payment history and outstanding balances

- Update personal and business information

- Receive notifications about upcoming deadlines

Enhanced User Experience

The platform is designed with user experience in mind, offering intuitive navigation and easy-to-understand interfaces. This ensures that even first-time users can quickly get up to speed with the system.

Benefits of Using Mass Tax Connect

Increased Efficiency

By automating many tax-related processes, Mass Tax Connect reduces the time and effort required to manage your tax obligations. This allows you to focus on other important aspects of your life or business.

Improved Security

Security is a top priority for Mass Tax Connect. The platform employs advanced encryption and authentication methods to protect your sensitive information from unauthorized access.

Read also:Who Is Jimmy Humilde Discovering The Rising Star And His Impact

Setting Up Your Mass Tax Connect Account

Creating a New Account

Setting up a Mass Tax Connect account is a straightforward process. Follow these steps to create your account:

- Visit the official Mass Tax Connect website

- Click on the "Register" button

- Provide the required information, such as your Social Security Number or Employer Identification Number

- Set up a username and password

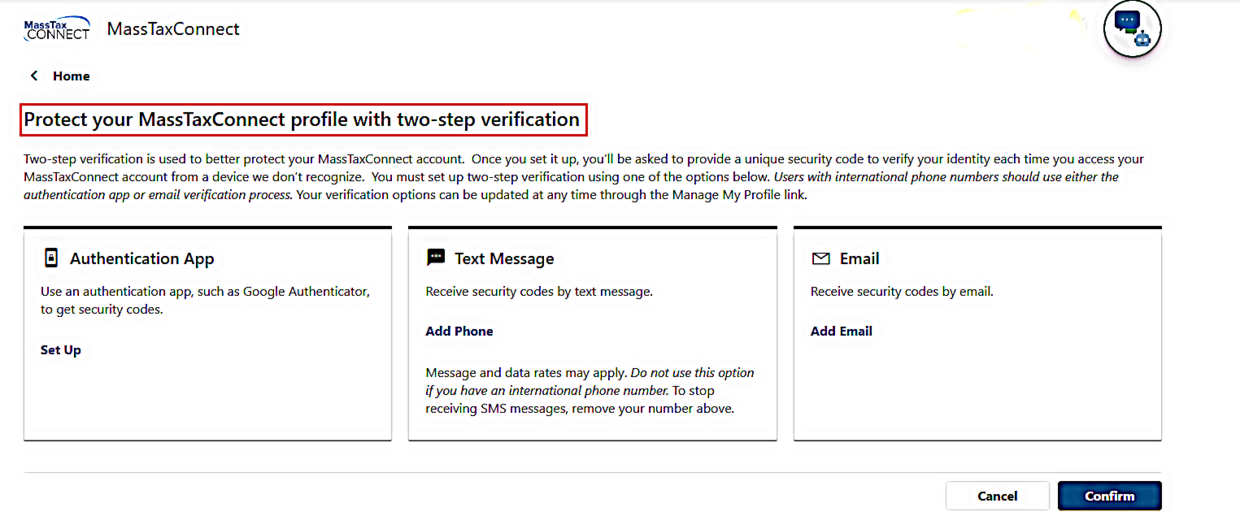

Verifying Your Account

Once you've created your account, you'll need to verify it to ensure its authenticity. This process typically involves receiving a verification code via email or text message.

Step-by-Step Guide to Mass Tax Connect Login

Accessing the Platform

To log in to Mass Tax Connect, follow these simple steps:

- Go to the Mass Tax Connect website

- Enter your username and password in the designated fields

- Click the "Login" button

Forgotten Credentials

If you've forgotten your username or password, don't worry. The platform provides options to reset your credentials securely. Simply click on the "Forgot Username/Password" link and follow the prompts.

Common Issues and Troubleshooting Tips

Account Access Problems

Occasionally, users may encounter issues when trying to access their Mass Tax Connect account. Here are some common problems and their solutions:

- Incorrect Login Credentials: Double-check that you're entering the correct username and password.

- Technical Glitches: Clear your browser cache or try accessing the platform from a different device.

Contacting Support

If you're unable to resolve the issue on your own, don't hesitate to contact Mass Tax Connect support. They are available to assist you with any questions or concerns you may have.

Ensuring Account Security

Best Practices for Security

Protecting your Mass Tax Connect account is essential to safeguard your personal and financial information. Here are some tips to enhance your account security:

- Create a strong, unique password

- Enable two-factor authentication

- Avoid sharing your login credentials with others

Recognizing Phishing Scams

Be cautious of phishing scams that attempt to steal your login information. Always verify the authenticity of emails or messages claiming to be from Mass Tax Connect before clicking on any links.

Filing Taxes Through Mass Tax Connect

Electronic Filing Process

Filing taxes through Mass Tax Connect is a breeze. The platform provides a step-by-step guide to help you complete the process efficiently. Here's what you can expect:

- Gather all necessary tax documents

- Log in to your Mass Tax Connect account

- Select the "File Taxes" option

- Follow the prompts to input your tax information

- Submit your tax return and confirm receipt

Tracking Your Tax Return

Once you've filed your taxes, you can track the status of your return through Mass Tax Connect. This feature allows you to stay informed about the progress of your submission and any potential issues that may arise.

Additional Resources and Support

Official Documentation

For more detailed information about Mass Tax Connect, refer to the official documentation provided by the Massachusetts Department of Revenue. This resource covers a wide range of topics, from account setup to advanced features.

Community Forums

Engaging with the Mass Tax Connect community can be beneficial for learning tips and tricks from other users. Join forums or discussion groups to exchange insights and solutions.

Conclusion and Call to Action

Mass Tax Connect Login is a powerful tool that simplifies the tax management process for residents of Massachusetts. By leveraging its features and functionalities, you can ensure compliance with tax regulations while saving time and effort.

We encourage you to take advantage of this platform and explore all it has to offer. Don't forget to share your experience with others and provide feedback to help improve the service. For more informative articles and updates, visit our website regularly.

References:

- Massachusetts Department of Revenue (DOR) Official Website

- Taxpayer Advocate Service

- Internal Revenue Service (IRS) Guidelines